Global demand for voluntary carbon credits

Source: NGFS; TSVCM; McKinsey

Demand Drivers

Shareholder pressure

from asset managers and investors to set and meet ambitious/net zero emissions targets

Compliance requirements

to reduce and disclose emissions and describe mitigating actions

Reputational risk

from weak targets or non-compliance

Inability to eliminate all emissions directly

given scale, costs and urgency

Global demand for voluntary carbon credits could increase by a factor of 15 by 2030, and a factor of 100 by 2050 – demand driven by shareholder pressures, regulatory disclosure and technology gaps

Carbon prices expected to rise due to increased demand and marginal cost of abatement

Source: Goldman Sachs

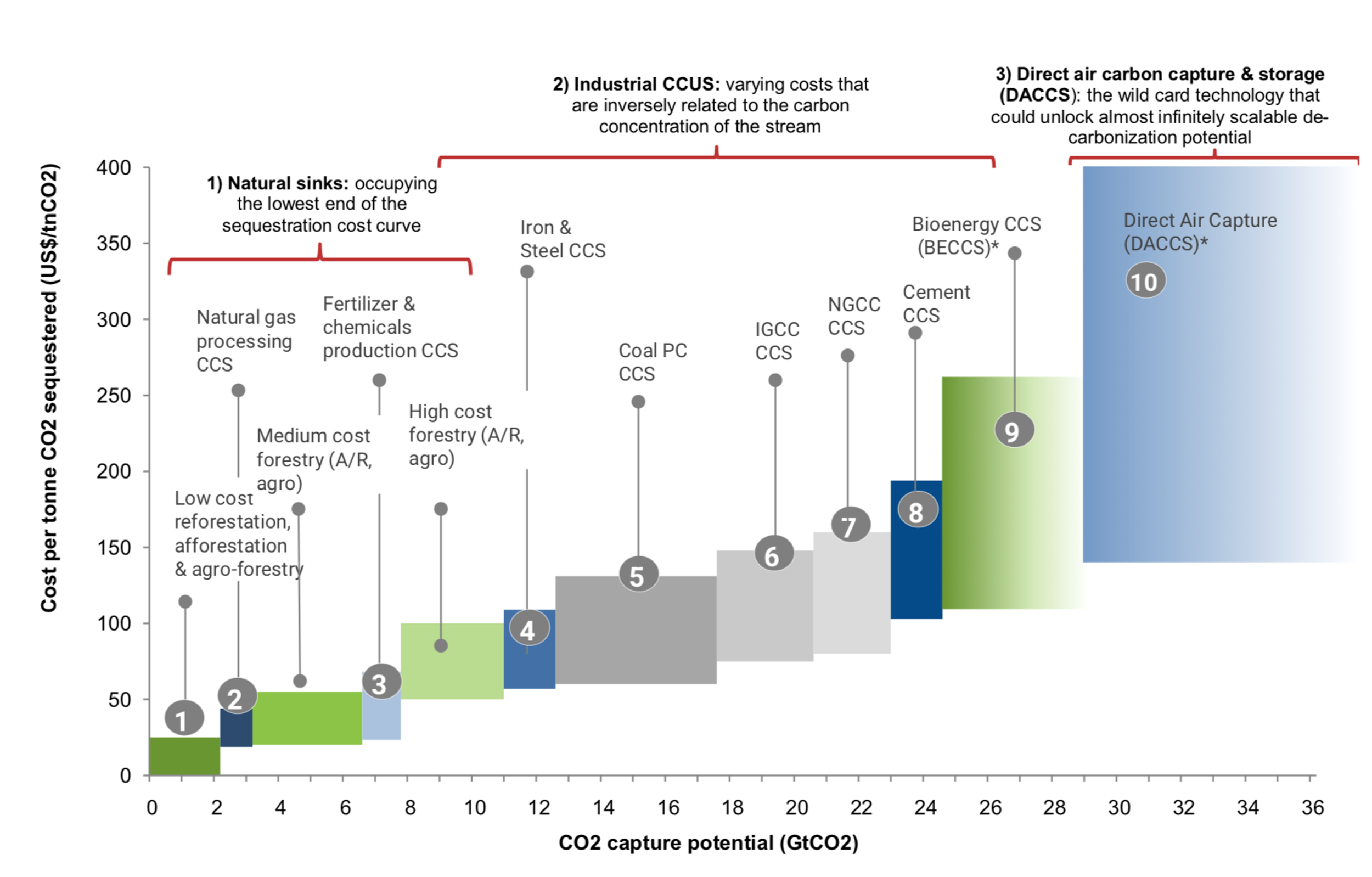

Forestry and natural sinks more generally represent the lowest end of the sequestration cost curve